For banks, social media stopped being “just marketing” a long time ago.

Every post published today is a public statement, a regulated communication, and in many cases a customer touchpoint that can influence trust in seconds. A single tweet can calm customers during a system outage, clarify misinformation, or — if mishandled — trigger regulatory scrutiny and reputational damage.

In other words, social media has become several things at once:

- A compliance-sensitive communication channel

- A real-time reputation management tool

- A frontline customer service layer

- A long-term trust-building platform

That complexity changes everything about how banks should approach social media management.

Why Choosing the Wrong Tool Is a Real Business Risk

Using the wrong social media management software isn’t just inefficient. It can be dangerous for a financial institution.

The consequences are very real:

- Posts going live without proper approvals, leading to compliance violations

- Inconsistent messaging across branches, regions, or product lines

- Limited visibility into who published what, and when

- Weak access controls that create security and data-handling risks

- A fragmented brand voice that slowly erodes customer trust

In a regulated industry, even small mistakes compound quickly.

The Difference the Right Software Makes

When banks choose the right social media management platform, the impact is immediate and strategic.

The right software enables banks to:

- Publish with confidence, knowing approvals and safeguards are in place

- Maintain a consistent voice across all regions and channels

- Respond quickly during sensitive moments without losing control

- Give compliance, marketing, and communications teams shared visibility

- Scale social media operations without increasing risk

Instead of reacting defensively, banks gain control.

What This Guide Will Help You Decide

Not all social media tools are built for regulated environments and most comparisons overlook what banks actually need.

This guide is designed to do three things:

- Clarify the real requirements banks should expect from social media software

- Explain how to evaluate platforms through a compliance and governance lens

- Identify which tools are genuinely suitable for regulated financial institutions, not just generic brands

The goal isn’t to find the flashiest tool.

It’s to find the one that lets banks communicate clearly, safely, and confidently every single day.

Why Social Media Management Is Fundamentally Different for Banks

Banks don’t use social media the way most brands do.

For a retail company, a social post is often a marketing message.

For a bank, a social post can be a regulated statement, a customer assurance, or a legally reviewable communication, sometimes all at the same time.

That difference changes everything.

Banks operate under tighter constraints than almost any other industry, and social media sits directly at the intersection of marketing, compliance, legal oversight, and public trust.

Regulation Is Always in the Room

Unlike startups or consumer brands, banks cannot treat social media as an experimental or informal channel.

Every piece of content may fall under:

- Financial communication regulations

- Advertising and disclosure requirements

- Record-keeping and audit obligations

- Regional and cross-border compliance frameworks

What looks like a simple tweet or reply can later be reviewed as an official statement.

That means even short, reactive interactions, a reply to a customer complaint or a scheduled promotional post, must meet the same standards as more traditional financial communications.

“Just Posting” Is Not an Option for Banks

For most companies, a social media manager can draft, edit, and publish content quickly.

For banks, that approach is risky.

Content often needs:

- Internal review and approval

- Legal or compliance sign-off

- Clear documentation of who approved and published it

- An archive that proves exactly what went live and when

Speed still matters especially during outages or crises but uncontrolled speed is a liability.

One Post, Many Jurisdictions

Another challenge unique to banks is geography.

A single post can be visible:

- Across different countries

- Under different regulatory regimes

- To customers governed by different financial authorities

What is acceptable language in one market may be restricted in another. Social media management software must account for this complexity, not ignore it.

Why Lightweight Social Tools Fall Short

Many social media tools are built for:

- Creators

- Small businesses

- Fast-moving marketing teams

They prioritize ease, speed, and growth often at the expense of governance and traceability.

For banks, this creates immediate problems:

- Limited approval workflows

- Weak access controls

- Poor audit trails

- Inadequate content archiving

These tools may work perfectly for influencers or startups, but they are fundamentally misaligned with the realities of regulated financial institutions.

Social Media for Banks Is a Risk-Controlled Operation

At its core, social media management in banking is not about posting more.

It’s about:

- Reducing risk

- Preserving trust

- Ensuring consistency

- Maintaining compliance without slowing down communication

That requires software designed with structure, visibility, and control at its foundation not bolted on as an afterthought.

Core Requirements for Banking-Grade Social Media Software

Before comparing vendors or feature lists, banks need to get one thing clear:

not all social media software is built for regulated environments.

For financial institutions, certain requirements are not “nice to have.”

They are non-negotiable.

A banking-grade social media platform must be designed to reduce risk, enforce control, and scale safely without slowing communication to a crawl.

Enterprise-Level Security and Access Control

In banking, access control is not just an IT concern, it’s a reputational safeguard.

Social media software must ensure that:

- Only the right people can access the right accounts

- Sensitive actions are restricted and traceable

- Human error is minimized through structure, not training alone

This means robust role-based permissions, where drafting, approving, and publishing are clearly separated.

Multi-factor authentication is essential, not optional.

And every integration must rely on secure, officially supported APIs.

A single misconfigured permission — one wrong click by the wrong user — can turn into a public incident or a regulatory issue. Banking software exists to prevent exactly that.

Centralized Multi-Account Management at Scale

Banks rarely operate a single social account.

They manage:

- Corporate brand channels

- Regional and country-level accounts

- Product-specific profiles

- Customer service and support handles

Without centralized control, these accounts quickly become fragmented, inconsistent, and difficult to govern.

Banking-grade platforms must allow teams to manage dozens or even hundreds of accounts from a single, unified environment while still applying consistent rules, permissions, and oversight across all of them.

Decentralized visibility is a risk. Centralized governance is a necessity.

Structured Pre-Approval and Publishing Workflows

For banks, publishing should never be an impulsive action.

Every post must pass through a defined process:

- Compliance review

- Legal approval (when required)

- Brand and tone alignment

Effective platforms formalize this process into clear workflows:

draft → review → approve → publish

Approvals should be logged automatically, not tracked through email threads or spreadsheets. Accountability must be visible, auditable, and unambiguous.

This structure doesn’t slow teams down, it protects them.

Archiving and Audit Readiness by Design

In banking, “What did we post last year?” is not a theoretical question.

Banks must be able to:

- Archive every post, reply, and scheduled message

- Retrieve historical content quickly and accurately

- Prove exactly what was published, when it went live, and who authorized it

This is essential for regulatory audits, internal reviews, and dispute resolution.

Social media software that treats archiving as an add-on rather than a foundation creates unnecessary exposure.

Audit readiness should be built in, not bolted on.

Platform Reliability and Legitimate API Access

Banks cannot afford to rely on tools that operate in grey areas.

That means no:

- Scraping-based automation

- Workarounds that violate platform policies

- Features that risk account restrictions or visibility penalties

Social accounts are public assets. Losing access even temporarily can have real financial and reputational consequences.

For this reason, enterprise-level, officially supported API access is non-negotiable. Stability, predictability, and platform trust matter more than aggressive automation.

Banking-Grade Software Prioritizes Control Over Convenience

Many social media tools are optimized for speed and growth.

Banking-grade tools are optimized for:

- Control

- Transparency

- Accountability

- Risk reduction

The difference is intentional.

For banks, social media success is not measured by how fast something can be posted but by how confidently it can be published, reviewed, defended, and audited later.

Key Social Platforms Banks Must Support

For banks, social media is not about “being everywhere.”

It’s about being present, consistent, and reliable on the platforms that matter most, especially when trust is on the line.

Any serious social media management software for banks must reliably support the following platforms:

X: Public Announcements and Crisis Communication

X has become the fastest channel for real-time communication.

Banks use it for:

- Service outage updates

- Security clarifications

- Misinformation control

- Regulatory or market-sensitive announcements

According to industry crisis-response benchmarks, over 60% of customers now expect real-time updates via social platforms during service disruptions, and X is usually the first place they check.

When minutes matter, banks need tools that allow fast but controlled publishing, without bypassing governance.

LinkedIn: Employer Branding and Thought Leadership

LinkedIn is not optional for banks.

It plays a critical role in:

- Employer branding

- Executive visibility

- Investor and institutional trust

- Thought leadership on financial topics

Research consistently shows that B2B trust is strongly influenced by executive and institutional presence on LinkedIn, especially in regulated industries like finance.

For banks, consistency and tone matter here more than volume.

Facebook: Customer Communication at Scale

Despite changes in audience behavior, Facebook remains one of the most important platforms for:

- Customer inquiries

- Community updates

- Regional branch communication

In many regions, Facebook is still the primary channel for customer service interactions, particularly among retail banking customers.

This requires:

- Clear ownership

- Moderation controls

- Message consistency

Instagram: Brand Storytelling and Humanization

Instagram plays a softer — but increasingly important — role.

Banks use it to:

- Humanize the brand

- Communicate values

- Highlight community initiatives

- Reach younger demographics

With Gen Z and Millennials now making up a growing share of new banking customers, Instagram helps banks feel accessible without compromising professionalism.

Why Cross-Platform Consistency Matters

During sensitive events — outages, policy changes, economic volatility — inconsistent messaging across platforms can cause confusion or panic.

Banks need tools that ensure:

- The same message goes out everywhere

- Timing is synchronized

- Language is aligned

Consistency is not just a branding issue.

It’s a trust issue.

How Banks Should Evaluate Social Media Management Tools

The biggest mistake banks make is asking:

“Which tool is most popular?”

Popularity does not equal suitability in regulated environments.

Instead, banks should evaluate platforms using a different lens:

- Is compliance built into the system, not added later?

- Can it scale across regions, languages, and teams?

- Does it reduce operational and reputational risk?

- Does it provide real visibility and accountability?

With those questions in mind, let’s look at the platforms most often considered by banks.

Hootsuite: Enterprise Scale with Heavy Compliance Focus

Hootsuite is one of the most established enterprise social media platforms and is widely used by large organizations, including global banks.

Where Hootsuite Excels

Hootsuite is particularly strong in environments with:

- Complex approval hierarchies

- Large legal and compliance teams

- Extensive audit requirements

Its strengths include:

- Advanced approval workflows

- Granular access controls

- Detailed audit logs

- Broad platform coverage

For banks operating across many jurisdictions, this level of governance can be essential.

Trade-Offs to Consider

That depth comes at a cost:

- Complex onboarding and setup

- Steep learning curve for teams

- Higher enterprise pricing

- More functionality than smaller banks may need

Hootsuite performs best when governance complexity is extremely high but it can feel heavy for mid-sized institutions.

Circleboom: Structured, Safe, and Enterprise-Friendly

Circleboom stands out for banks that value control, predictability, and platform trust over experimental tactics.

It is designed around official platform integrations, not scraping or gray-area automation, a critical distinction for financial institutions.

Keep in mind that the API provides a more accurate real-time data stream than the X interface itself. While the platform UI may experience lag, the API captures and reflects new developments instantaneously.

Circleboom has the official Enterprise API, we don't scrape data from X!

If you are a creator on X and want to know about the latest developments regarding the algorithm changes, engagement strategies, payout boosts, etc., you can join Circleboom's X Creator Growth Lab Community and enjoy a free space to learn from and contribute to!

Why Circleboom Works Well for Banks

Circleboom focuses on the operational realities banks face every day:

- Centralized multi-account management

- Cross-platform publishing from a single dashboard

- Controlled scheduling and queue systems

- Automation that stays within platform rules

This allows banks to maintain a steady, compliant presence without exposing accounts to unnecessary risk.

Banks don’t need tools that “push limits.”

They need tools that behave predictably.

Governance and Workflow Advantages

From a governance perspective, Circleboom enables banks to:

- Separate drafting from publishing

- Maintain consistent posting schedules across teams

- Reduce manual errors caused by fragmented workflows

- Align brand voice across regions and channels

For regulated institutions, simplicity is not a weakness, it is a risk-reduction strategy.

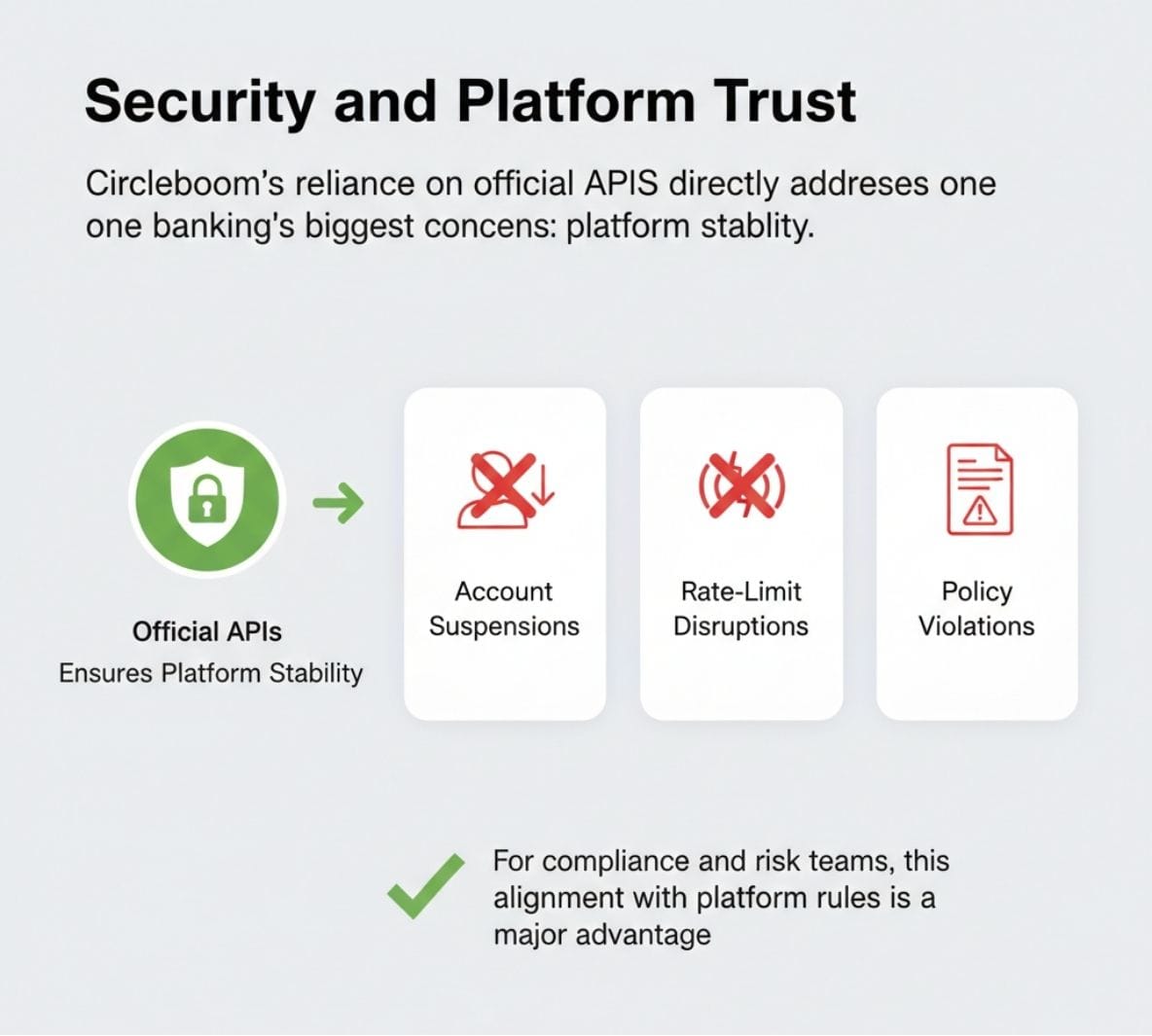

Security and Platform Trust

Circleboom’s reliance on official APIs directly addresses one of banking’s biggest concerns: platform stability.

This helps banks avoid:

- Account suspensions

- Rate-limit disruptions

- Policy violations

For compliance and risk teams, this alignment with platform rules is a major advantage.

Sprout Social: Analytics-Driven and Client-Facing

Sprout Social is often chosen by organizations that prioritize insight, reporting, and brand perception.

Where Sprout Social Fits Best

Sprout Social offers:

- Strong engagement analytics

- Clean, executive-ready reports

- Solid tools for monitoring brand sentiment

It is frequently used by:

- Digital-first banks

- Challenger banks

- Fintech-bank hybrids

- Marketing-led financial institutions

Data-driven teams often appreciate its clarity.

Limitations in Traditional Banking Environments

For more conservative institutions, there are trade-offs:

- Less flexible compliance workflows than heavier enterprise tools

- Higher per-user costs

- Limited customization for complex approval chains

Sprout Social shines in analytics but may require additional processes to meet strict compliance needs.

Why Banks Avoid “Growth Hacker” Tools

Many social media tools are built for creators, agencies, or startups.

They often emphasize:

- Aggressive automation

- Engagement manipulation

- Scraping-based data collection

For banks, these are immediate red flags.

Even if these tools deliver short-term results, they introduce:

- Platform policy risk

- Account stability issues

- Compliance uncertainty

Banks don’t need virality.

They need reliability.

The Right Choice Depends on Banking Maturity

There is no single “best” tool for every bank.

Large Multinational Banks

Best fit:

- Hootsuite for maximum governance

- Circleboom as a structured publishing layer

Regional and Mid-Size Banks

Best fit:

- Circleboom for balance between control and usability

- Sprout Social when analytics is the main priority

Digital-First and Challenger Banks

Best fit:

- Sprout Social for insight and reporting

- Circleboom for safe automation and consistency

Final Verdict: What Banks Should Truly Optimize For

The best social media software for banks is not the one with the longest feature list.

It’s the one that:

- Minimizes regulatory risk

- Centralizes control

- Preserves platform trust

- Scales across teams and regions

- Keeps communication consistent, traceable, and auditable

For most banks, safe structure beats aggressive growth.

And viewed through that lens, platforms like Circleboom, Hootsuite, and Sprout Social consistently outperform generic social media tools built for unregulated industries.