In investing, timing is everything.

By the time a funding round becomes public, the real opportunity is often already gone. Press releases, headline announcements, and “breaking news” usually arrive after institutional interest has formed, not before.

That’s why more investors are searching for ways to follow the “smart money” in real time.

One of the most overlooked signals?

Who Venture Capital firms and fund managers follow on X (Twitter).

This article explains:

- why following activity is an early-stage investment signal

- how VC and fund manager followings reveal institutional interest

- how to monitor these signals automatically

- and how Circleboom makes this process scalable, trackable, and actionable

What Does “Follow the Smart Money” Mean?

“Smart money” refers to capital deployed by:

- Venture Capital firms

- hedge funds

- institutional investors

- professional fund managers

These actors have:

- access to private deal flow

- industry expertise

- research teams and insider-level insights

Before funding rounds are announced, these players often begin quietly tracking projects, founders, and teams, and one of the first public traces of that interest is who they follow on X.

Why X (Twitter) Is a Goldmine for Early Investment Signals

X is not just a social network, it’s a real-time information graph.

VCs, partners, and fund managers use X to:

- track founders

- follow early-stage startups

- monitor emerging protocols and tools

- stay close to builders before announcements

A follow from a well-known VC account is often:

- earlier than a press release

- earlier than Crunchbase updates

- earlier than public funding news

In many cases, it’s the first visible signal of institutional attention.

Why Following Activity Matters More Than Likes or Tweets

Likes and retweets are cheap signals. Following is not.

When a VC or fund manager follows an account, it often means:

- they want ongoing visibility into the project

- they’re monitoring progress over time

- internal research has already started

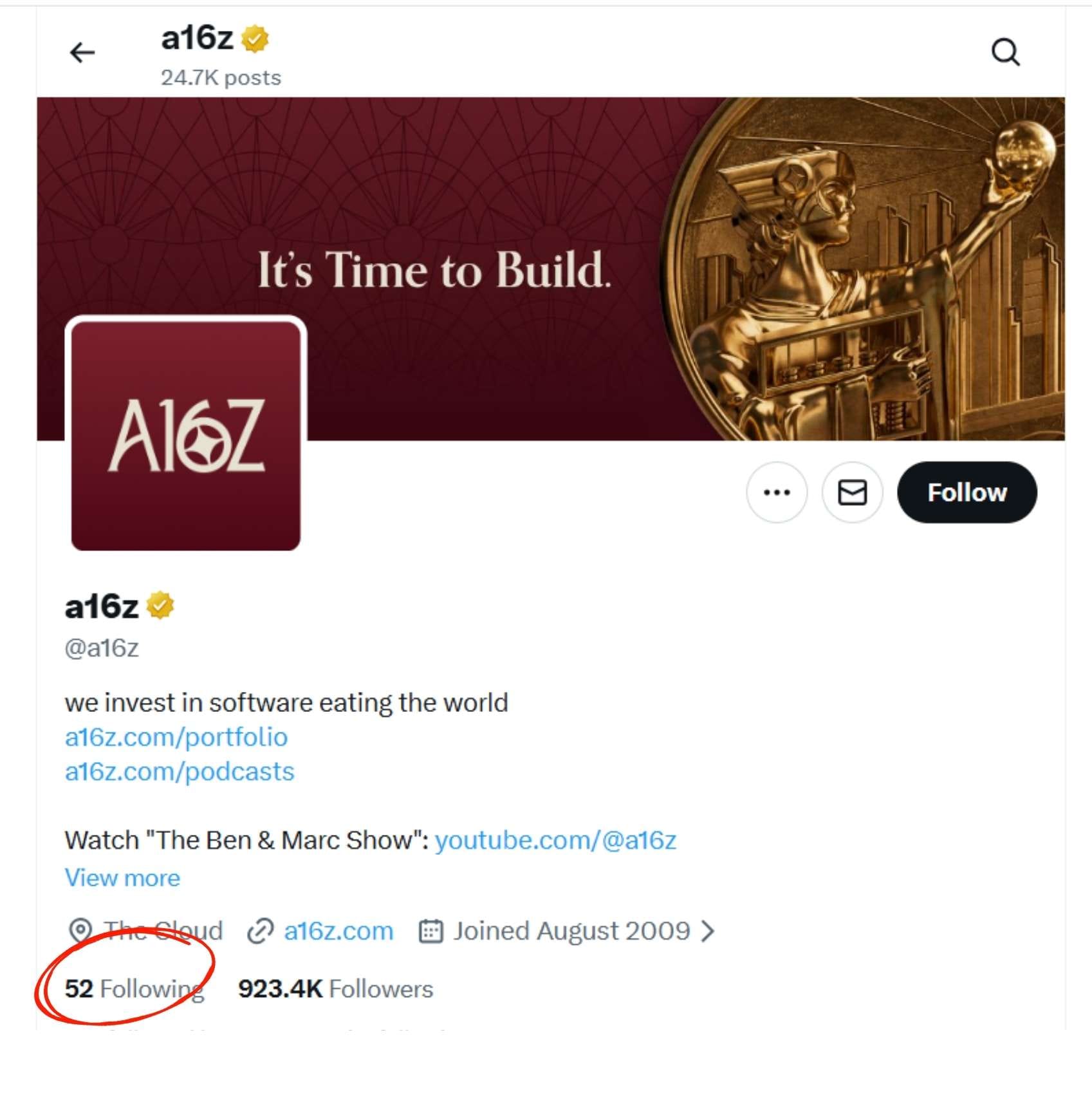

a16z is a big Venture Capital firm and they follow only 52 accounts. This means they are very selective; their 53rd following will be an important account for their investment strategies in the future.

Following is a commitment signal, not a casual interaction.

This is especially powerful when:

- multiple VCs follow the same project within a short window

- a fund partner follows a founder before a product launch

- institutional accounts begin following a previously low-visibility project

The Problem: Manually Tracking This Is Impossible at Scale

If you want to monitor:

- 20 VC firms

- 50 fund managers

- dozens of angel investors

Manually checking their followings every day is:

- time-consuming

- error-prone

- not realistic

X itself does not provide:

- alerts for new followings

- historical follow tracking

- daily summaries of changes

This is where automation becomes essential.

How Circleboom Enables Real-Time Smart Money Tracking

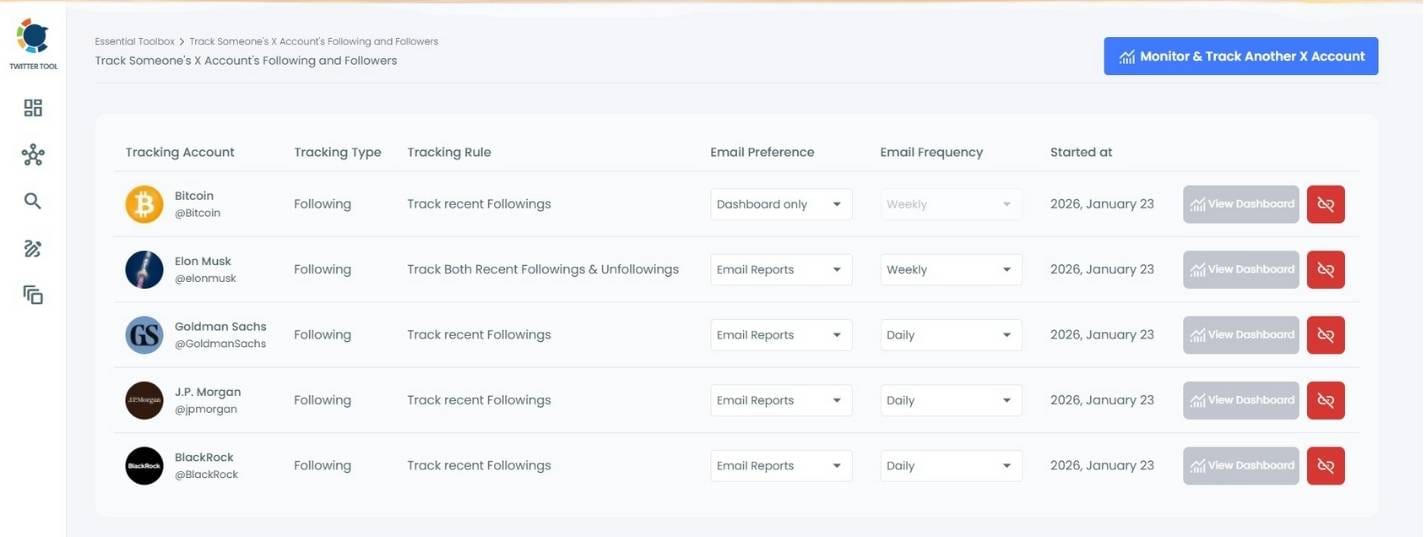

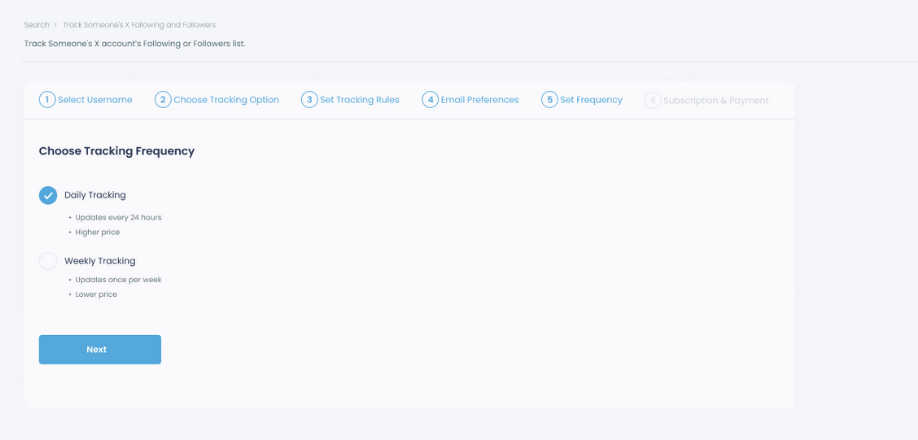

Circleboom recently introduced a feature that changes how this research is done.

With Circleboom, you can:

- track the followings of specific X accounts

- detect newly followed accounts automatically

- receive daily email reports

- monitor changes over time without manual checks

Instead of watching the timeline, you watch behavior.

Keep in mind that the API provides a more accurate real-time data stream than the X interface itself. While the platform UI may experience lag, the API captures and reflects new developments instantaneously.

Circleboom has the official Enterpise API, we don't scrape data from X!

How the Workflow Looks in Practice

Step 1: Identify Smart Money Accounts

You select:

- VC firm accounts

- individual partners

- fund managers

- notable angels

These become your watchlist.

Major Global Venture Capital Firms on X

- Andreessen Horowitz (@a16z)

One of the most influential VCs in tech, crypto, AI, and consumer startups. - Sequoia Capital (@sequoia)

Early backer of Apple, Google, Airbnb, Stripe — their follows are closely watched. - Accel (@Accel)

Strong presence in SaaS, fintech, and enterprise tech. - Lightspeed Venture Partners (@lightspeedvp)

Active across AI, crypto, and global startups. - Bessemer Venture Partners (@BVP)

Known for cloud, SaaS, and developer-focused companies. - Benchmark (@benchmark)

Small fund, high conviction — changes in following behavior are often meaningful.

Crypto & Web3-Focused VCs

- Paradigm (@paradigm)

One of the strongest crypto-native investment firms. - Pantera Capital (@PanteraCapital)

Early mover in blockchain and digital assets. - Multicoin Capital (@multicoincap)

Very active on X; follows often signal early-stage crypto interest. - Electric Capital (@ElectricCapital)

Known for developer ecosystem research and Web3 investments.

Corporate & Strategic VC Arms

- GV (@GVteam)

Alphabet’s venture arm with broad tech coverage.

Intel Capital (@IntelCapital)

Focused on deep tech, AI, and infrastructure.

Step 2: Track Their Followings Automatically

Circleboom monitors:

- who these accounts start following

- when the follow happens

- patterns across multiple accounts

You no longer need to refresh profiles manually.

Step 3: Receive Daily Email Alerts

Every day, you get a report showing:

- newly followed projects

- emerging overlaps between investors

- accounts gaining institutional attention

This turns passive observation into structured intelligence.

Why This Gives You an Edge Over Traditional Research

Traditional investment research often reacts to:

- funding announcements

- media coverage

- public databases

Following analysis works before those signals appear.

In practice, this allows you to:

- discover startups earlier

- spot narrative shifts before markets price them in

- validate your own research with institutional behavior

You’re not guessing. You’re observing what professionals are paying attention to.

Who Benefits Most From This Strategy?

This approach is especially valuable for:

- angel investors

- early-stage VCs

- crypto and Web3 analysts

- market researchers

- founders tracking competitor interest

Anyone whose edge depends on early awareness, not late confirmation.

Ethical & Practical Considerations

It’s important to note:

- this is public data

- no private information is accessed

- no scraping of restricted content

You’re simply analyzing public following behavior, but doing it systematically instead of manually.

Why Circleboom Is Different From Manual Tracking

Manual approach:

- inconsistent

- easy to miss changes

- doesn’t scale

Circleboom’s approach:

- automated

- repeatable

- alert-based

- scalable across many accounts

It turns social data into investment-grade signals.

Final Thoughts: Information Moves Before Capital Does

Capital rarely moves first.

Attention moves first.

By tracking who VCs and fund managers choose to follow, you gain visibility into:

- what’s being researched

- what’s being monitored

- what may soon be funded

With Circleboom’s follow-tracking and daily email reports, following the smart money stops being a theory and becomes a practical, repeatable strategy.

FAQs: Following the Smart Money on X

Can following activity really indicate investment interest?

Yes. Following is often an early signal of research, monitoring, or pre-deal interest especially when done by institutional accounts.

Does X provide alerts for new followings?

No. X does not notify users when accounts they follow start following someone new.

Is this data public and allowed?

Yes. Following activity is public information on X.

How often should followings be checked?

Daily monitoring is ideal, which is why automated email reports are so effective.

Can Circleboom track multiple VC accounts at once?

Yes. You can monitor multiple accounts simultaneously and spot overlapping interest.