Twitter has quietly evolved into one of the most powerful platforms for investors.

When you follow the right people, Twitter becomes a real-time intelligence network, one where you can spot trends early, gauge market sentiment as it shifts, and learn directly from experienced investors, traders, and analysts who openly share how they think.

Unlike traditional financial media, Twitter moves fast.

Market reactions, macro commentary, earnings interpretations, and unexpected signals often surface there before they appear on news sites or reports.

But there’s a catch.

The value you get from Twitter depends entirely on who you follow.

Follow the wrong accounts, and your timeline turns into noise—recycled headlines, shallow takes, and constant hype.

Follow the right ones, and it becomes a daily stream of insights that actually help you think more clearly about investing.

Below are 20 investment-focused Twitter accounts that consistently share thoughtful analysis, valuable data, and perspectives worth paying attention to.

20 Best Investor Twitter Accounts to Follow on X

1. Liz Ann Sonders (@LizAnnSonders) – Clear, Chart-Driven Market Insights

@LizAnnSonders stands out on X for delivering sharp, data-backed commentary on the economy and stocks.

Her posts feature meticulously crafted charts covering sector performance, market breadth, consumer sentiment, manufacturing data, inflation trends, buybacks, and long-term valuation signals. She has a rare ability to translate complex macro and market data into visuals and explanations that everyday investors can actually use.

Professional, consistent, and refreshingly free of hype, her content focuses on what truly matters beneath the surface.

A must-follow for investors who value clarity over noise.

2. Charlie Bilello (@charliebilello) – Data-Rich Facts and Historical Context

@charliebilello delivers some of the most compelling, fact-based market commentary on X through clean, informative charts and concise insights.

His charts highlight long-term asset class returns, sector cycles, commodities, yields, debt levels, and historical extremes, often placing today’s market moves into decades-long context. Instead of reacting to headlines, he lets the data speak.

If you want facts over opinions and history over speculation, his feed is essential reading.

3. 10-K Diver (@10kdiver) – Mastering Investing Through Simple, Powerful Threads

@10kdiver brings a unique teaching style to X, turning core investing and compounding concepts into engaging, easy-to-follow threads that stick with you long after reading.

Using relatable analogies and step-by-step reasoning, he explains compounding, expected value, probability, diversification mistakes, margin of safety, and long-term decision-making. His content doesn’t chase stocks, it builds better mental models.

Perfect for investors who want to understand why things work, not just what to buy.

4. Peter Mallouk (@PeterMallouk) – Practical Wealth Wisdom and Long-Term Perspective

@PeterMallouk delivers straightforward, no-nonsense insights on building and protecting wealth, blending sharp market commentary with timeless financial principles.

His posts emphasize diversification, staying invested during volatility, and avoiding the traps of short-term forecasting, often backed by historical data and simple charts. He also reminds investors that money is a tool, not the goal, regularly tying investing back to life priorities and mindset.

Balanced, experienced, and grounded, his content helps investors stay focused on what actually compounds over time.

5. Brian Stoffel (@Brian_Stoffel_) – Demystifying Stocks with Transparent, Educational Content

@Brian_Stoffel_ excels at breaking down complex investing topics into clear, actionable lessons that make stock analysis feel approachable for everyday investors.

His threads cover valuation frameworks, financial statement analysis, identifying economic moats, and recognizing red flags, often using real companies as examples. He’s also transparent about his own thinking and portfolio decisions, which makes his content relatable and instructive.

Ideal for investors who want to build real analytical confidence without hype.

6.The Chartist (@thechartist) – Systematic Momentum and Trend-Following Expertise

@thechartist delivers proven, rules-based trading strategies with a strong emphasis on momentum, trend following, and disciplined execution across global markets, particularly ASX and US equities.

His posts include backtests, equity curves, drawdown analysis, and lessons from different market regimes. Rather than obsessing over predictions, he emphasizes process, discipline, and risk management, especially during prolonged bear or sideways markets.

A strong follow for investors and traders who value tested systems over opinions.

7. Scott Redler (@RedDogT3) – Technical Levels, Momentum Plays, and Trader Mindset

@RedDogT3 delivers fast-paced, actionable technical analysis with a focus on key levels, moving averages, relative strength, and high-probability setups across major indices and growth stocks.

He regularly shares charts highlighting breakouts, trend shifts, relative strength, and sector rotation, alongside practical trading routines and mindset insights. His content is energetic, direct, and highly actionable for active traders.

Best suited for short- to medium-term traders who rely on technicals and momentum.

8. Bora Ozkent (@BoraOzkent) – Sharp Takes on Nasdaq, Tech Trends, and Global Markets

@BoraOzkent delivers candid, insightful commentary focused on Nasdaq and technology-driven investments, with a keen eye on emerging trends and broader market dynamics.

His posts dive into topics like AI integration in industries, Bitcoin mining shifts, autonomous tech adoption, valuation debates (why quality growth stocks often outperform despite high multiples), and how geopolitical events ripple through portfolios.

He shares detailed video breakdowns of market impacts, from policy changes to commodity moves, while emphasizing long-term growth over cycles, the pitfalls of index hugging, and why tech remains a core driver of wealth creation.

Direct, opinionated, and often humorous, with no tolerance for hype or misinformation, his content challenges conventional views and encourages disciplined, informed investing.

A refreshing follow for anyone tracking US tech stocks and innovative sectors with a global perspective.

9. SentimenTrader (@sentimentrader) – Contrarian Edge Through Sentiment Indicators

@sentimentrader delivers disciplined, evidence-based analysis focused on market sentiment, using proprietary models to gauge investor optimism, pessimism, and risk levels across stocks, sectors, commodities, and bonds.

Using proprietary indicators, his posts highlight extremes in fear and optimism that often precede market turning points. Charts covering breadth, positioning, insider activity, and sentiment models help investors understand crowd behavior rather than chase it.

An excellent complement to price-based analysis.

10. Brian Feroldi (@BrianFeroldi) – Visual Explanations That Make Investing Click

@BrianFeroldi turns dry financial concepts into bright, memorable visuals that simplify everything from profit margins and depreciation methods to valuation, operating leverage, and the rule of 72.

He breaks down accounting concepts, valuation basics, and long-term investing principles in a way that’s easy to remember and apply. No stock picks, just fundamentals, habits, and timeless lessons.

Perfect for visual learners and newer investors.

11. Lyn Alden (@LynAldenContact) – Macro Mastery with Clarity and Depth

@LynAldenContact delivers some of the most thoughtful and well-researched macro commentary on X.

Her content covers monetary systems, energy constraints, fiscal policy, global liquidity, and long-term asset allocation, often supported by historical data and clear frameworks. She connects big-picture forces to real investment outcomes.

A premier follow for investors who want to understand markets beyond short-term cycles.

12. Edwin Dorsey (@StockJabber) – Investigative Shorts and Curated Investment Resources

@StockJabber specializes in deep-dive exposés on questionable companies, uncovering promotional schemes, accounting red flags, and potential short opportunities through detailed research and clear breakdowns.

He exposes questionable business practices, highlights accounting red flags, and shares curated resources for serious investors. His work emphasizes skepticism, research discipline, and independent thinking.

Especially valuable for investors interested in shorts or forensic analysis.

13. Chris Kimble (@KimbleCharting) – Spotting Key Patterns and Inflection Points

@KimbleCharting delivers clean, focused technical analysis centered on classic chart patterns, support/resistance tests, and multi-year inflection zones across stocks, sectors, commodities, and bonds.

His posts focus on multi-year breakouts, structural shifts, and historical price memory, helping investors identify potential turning points rather than day-to-day noise.

A strong follow for technically-minded investors with patience.

14. Linda Raschke (@LindaRaschke) – Classic Technical Patterns and Pro-Level Timing

@LindaRaschke shares decades of professional trading experience.

Her posts highlight timeless chart patterns, gap behavior, swing analysis, and market traps, often with personal anecdotes and historical context. She keeps technical analysis simple, practical, and grounded in real market behavior.

A legendary voice for traders who respect proven techniques.

15. S. Joseph Burns (@SJosephBurns) – Trading Wisdom, Charts, and a Winning Mindset

@SJosephBurns blends practical technical analysis with a strong focus on trading psychology and risk management. His posts feature clean visuals such as breakout patterns, moving average structures, and risk management cheat sheets, often reinforced with timeless wisdom from legendary investors and economists.

Rather than chasing predictions, he emphasizes discipline, emotional control during drawdowns, proper position sizing, and building confidence in rules-based systems.

A valuable follow for traders who want to improve both execution and mindset for long-term consistency.

16. Ian McMillan (@the_chart_life) – Relatable Technical Analysis with a Humorous Edge

@the_chart_life delivers sharp technical analysis focused on market breadth, relative strength, and key levels across indices, sectors, and ETFs. His clean charts highlight trends, divergences, and momentum shifts, often paired with thoughtful questions that encourage discussion and perspective.

Balanced with light humor and self-aware commentary, his feed avoids hype and bold predictions, offering honest, chart-driven insights in an approachable, human tone.

A refreshing follow for technical traders who value clarity, context, and depth—without the drama.

17. Value Investigator (@value_invest12) – Deep Value Meets High-Growth Compounders

@value_invest12 shares research-driven analysis focused on undervalued companies with strong long-term compounding potential. His posts feature detailed threads on portfolio holdings, performance recaps, and contrarian ideas, often highlighting opportunities the broader market underestimates.

He regularly breaks down valuations, free cash flow trends, and key growth drivers across sectors like payments, health tech, and innovative pharma.

A strong follow for patient, fundamentals-focused investors searching for quality growth at reasonable prices.

18. Bob Elliott (@BobEUnlimited) – Institutional-Grade Macro with Real-World Clarity

@BobEUnlimited brings hedge-fund-level macro analysis to X, breaking down global economic trends, labor markets, central bank policy, and asset price drivers with clear, data-backed charts. His posts challenge overhyped narratives while grounding market moves in historical context and measurable forces.

Calm, evidence-driven, and focused on what actually moves markets, he offers a sharp macro lens without noise or drama.

A premier follow for investors seeking sophisticated macro insight with practical clarity.

19. Rekt Capital (@rektcapital) – Crypto Cycles and Long-Term Technical Mastery

@rektcapital delivers cycle-based technical analysis focused on historical patterns, recurring market structures, and key price levels across Bitcoin and major altcoins. His posts break down halving cycles, dominance shifts, multi-year support and resistance zones, and altcoin season dynamics using clear, data-rich charts.

Calm, methodical, and free of short-term hype, his insights help investors navigate crypto volatility with a long-term, technically grounded perspective.

A top follow for anyone serious about understanding crypto markets through repeatable cycle analysis.

20. Barry Ritholtz (@ritholtz) – Witty Takes on Markets and Common Sense Investing

@ritholtz offers sharp, experienced commentary on markets, economics, and behavioral biases with a mix of data, humor, and no-nonsense advice.

His posts cover current events, historical context, podcast clips, and critiques of Wall Street hype, emphasizing evidence-based decisions over speculation.

Engaging and often entertaining, he blends professional insights with relatable takes that cut through noise.

A great follow for balanced, big-picture perspective from a veteran money manager.

How I Found These Accounts Using Circleboom Twitter

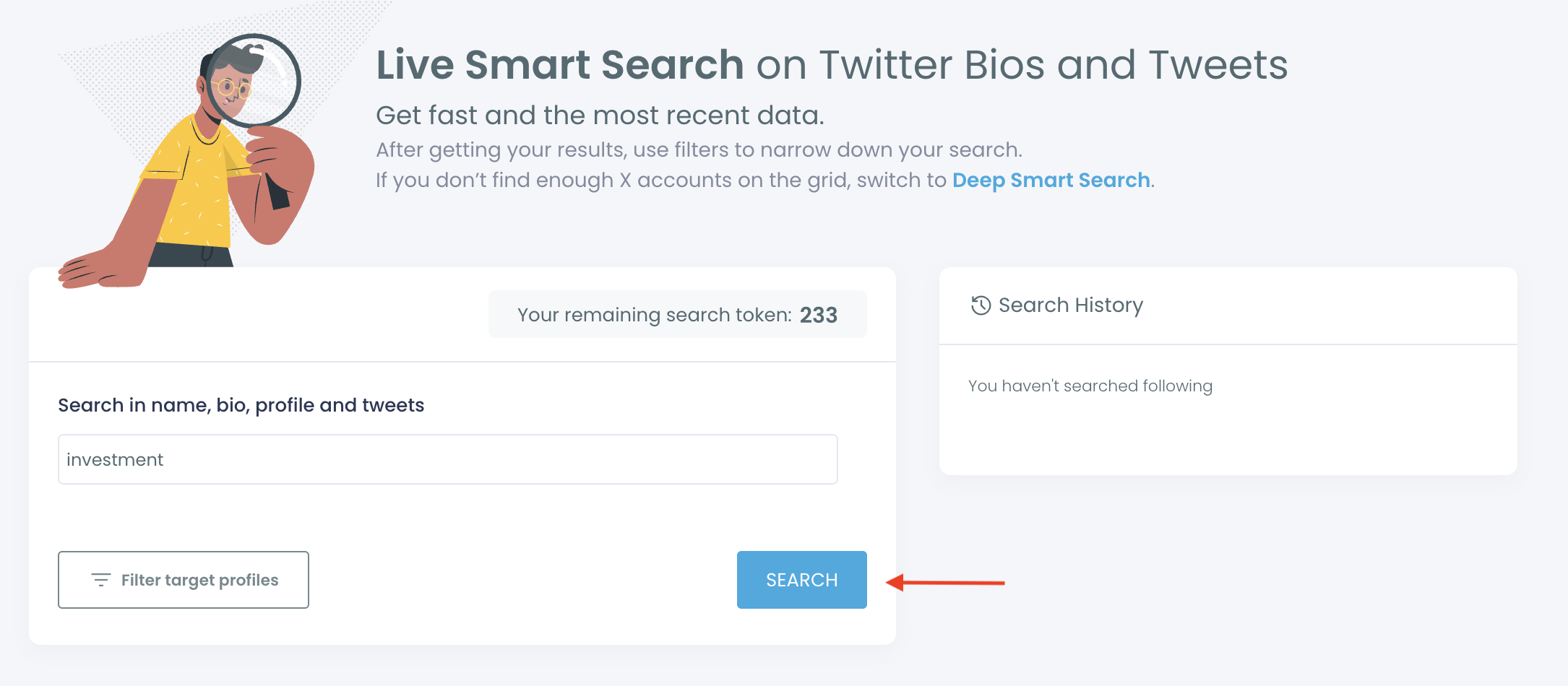

Instead of relying on Twitter’s built-in search, I used Circleboom Twitter’s Smart Search feature to find investment-focused accounts more efficiently.

Smart Search allows you to:

- Discover accounts based on investment-related keywords

- Narrow results to accounts that actually post and engage

- Eliminate irrelevant or inactive profiles quickly

Rather than scrolling endlessly, this approach turns discovery into a structured process.

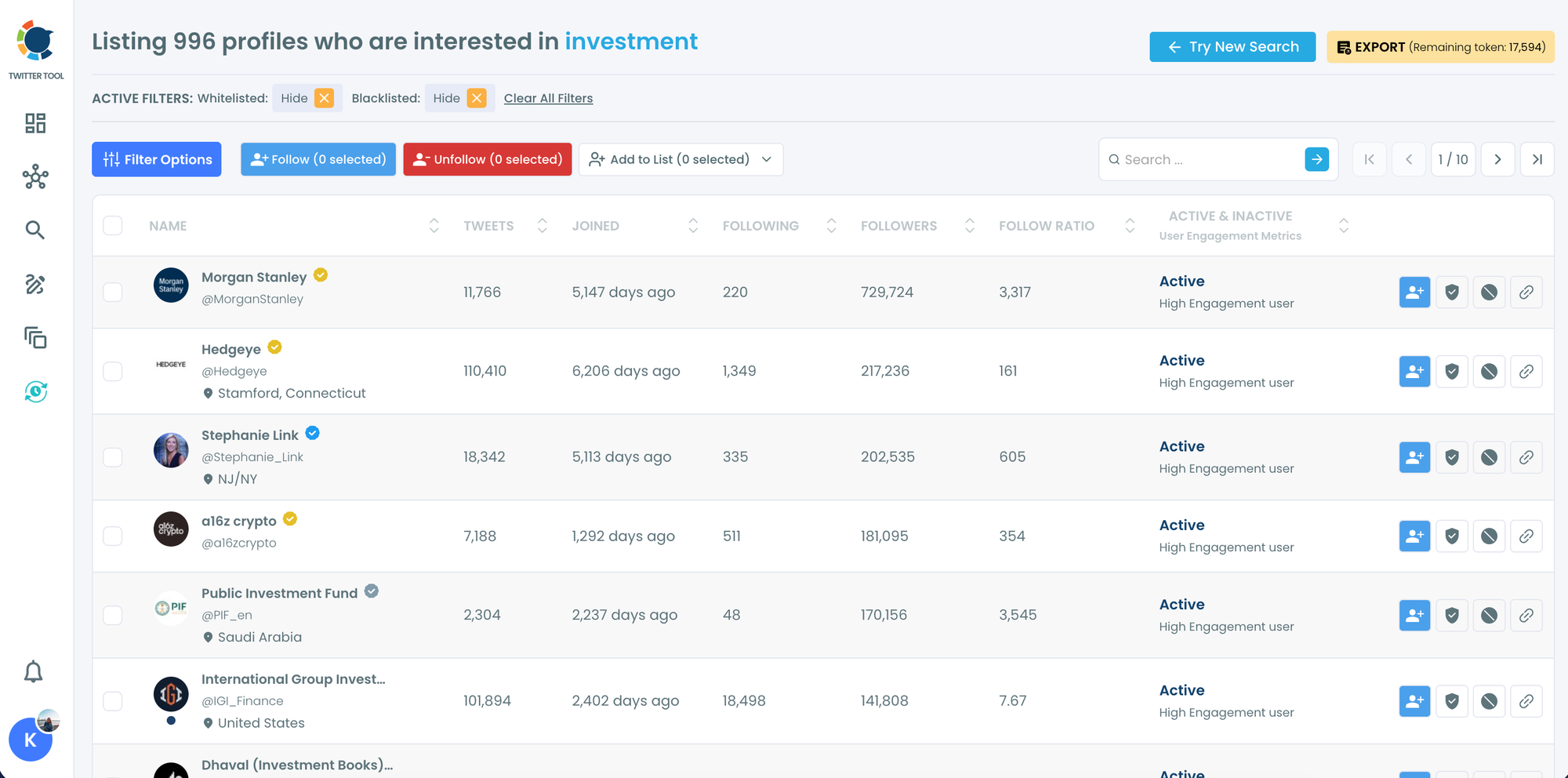

After running keyword searches, the next step is refinement. Accounts can be filtered so only the most relevant and consistent profiles remain. This makes it much easier to focus on accounts that share real insights, not recycled noise.

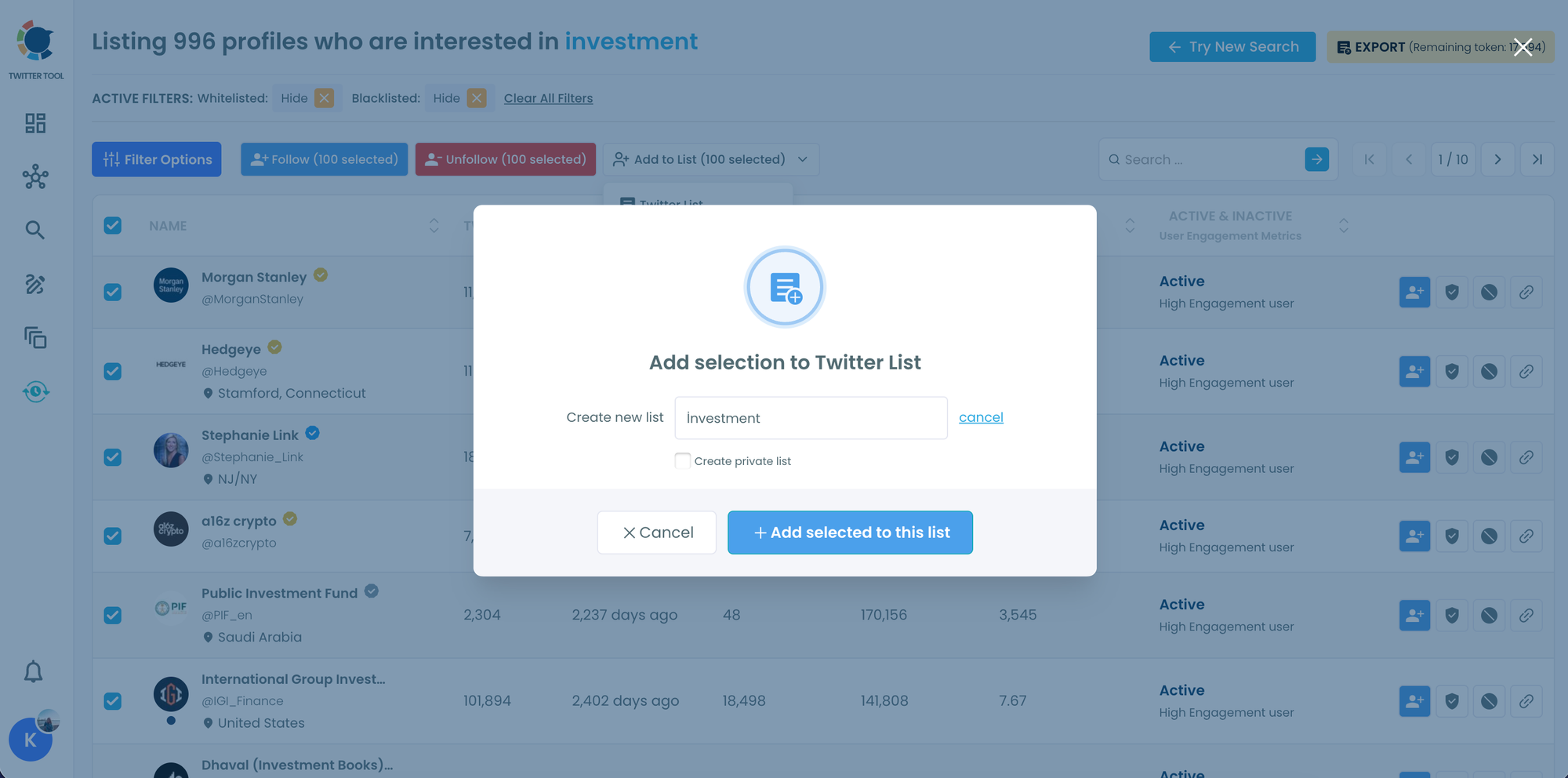

Once the best accounts are selected, Circleboom makes the next steps effortless:

- Follow all selected accounts in one click

- Create a dedicated Twitter investment list instantly

This transforms a scattered discovery process into a clean, organized investment feed you can check daily without distractions.

The Real Strategy: Tracking Who Big Accounts Follow

Following good accounts is powerful, but tracking who influential accounts follow is where things get really interesting.

Large accounts often signal interest quietly. A follow can be more meaningful than a tweet.

When a major investor, founder, or high-profile account starts following a company, project, or individual, it often reflects early curiosity or conviction. These signals usually appear before broader attention arrives.

Using Follow Alerts to Catch Early Signals

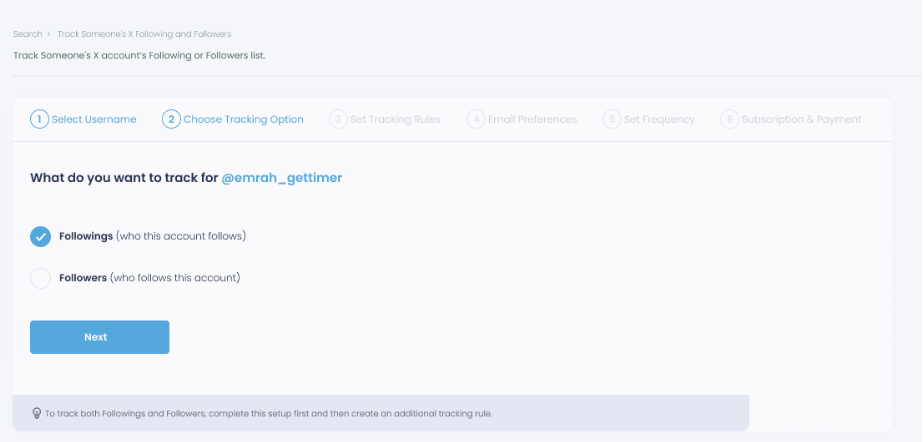

With Circleboom Twitter, you can go one step further by setting follow alerts.

This allows you to:

- Track any Twitter account

- See who they start following day by day

- Review new followings in a clean, structured list

Instead of manually checking profiles, the system shows you changes automatically.

Turning Follow Activity Into Investment Insights

Consider a simple scenario:

1️⃣ A large account starts following a relatively unknown project

2️⃣ That project gains attention shortly afterward

This pattern repeats constantly across markets.

By tracking follow activity:

- You spot narratives early

- You monitor behavior, not hype

- You build conviction based on signals, not trends

This doesn’t replace research. It enhances timing and awareness.

Final Thoughts

Twitter can be one of the most powerful investment platforms available, but only if it’s curated properly.

The goal isn’t to follow more accounts.

The goal is to follow smarter.

With the right discovery process, smart filtering, one-click list creation, and follow alerts, Twitter becomes more than a social feed. It becomes a real-time investment intelligence system.